Budapest Industrial Market Report - Q2 2024

2024.08.26.

The Budapest Research Forum (BRF, which comprises: CBRE, Colliers, Cushman & Wakefield, ESTON International, iO Partners and Robertson Hungary) sets out below its Q2 2024 industrial market snapshot.

The total modern industrial stock in Hungary amounted to 5,139,970 sq m at the end of Q2 2024. Greater Budapest reached 3,563,940 sq m, while the stock of Regional Hungary added up to 1,576,030 sq m. The size of the regional stock decreased by 28,500 sq m due to the deletion of the industrial park of Győr from the regional stock.

In Q2 2024, the speculative stock in Greater Budapest expanded with one building, HelloParks PT2, with a size of 41,780 sq m, while in the regional markets three new handovers were recorded with a size of 23,090 sq m. In the countryside, the park of IGPark Tiszaújváros was expanded by an additional 12,230 sq m, while the Alba Industrial Zone in Székesfehérvár was increased with two new buildings with a total of 10,800 sq m.

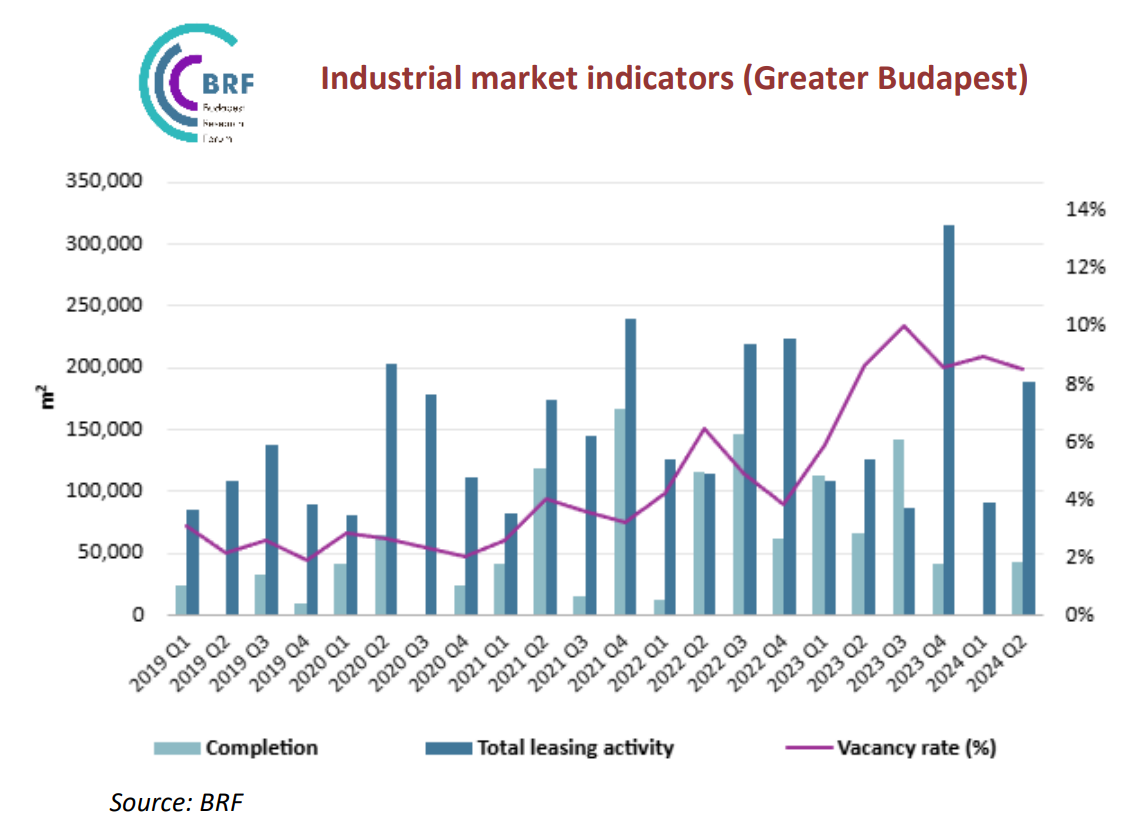

The vacancy rate at the end of Q2 2024 decreased to 8.5% in Greater Budapest, representing a 0.4 percentage points decrease quarter-on-quarter, while examining on a year-on-year basis, represents an only 0.1 percentage points of decrease. At the end of the quarter, a total of 303,050 sq m of logistics space was vacant in Greater Budapest, while vacant areas outside Budapest reached 133,930 sq m, corresponding to a vacancy rate of 8.5% as well, therefore the national countrywide vacancy rate stood at 8.5% as of Q2 2024.

Total demand in Greater Budapest amounted to 188,350 sq m in Q2 2024, indicating an increase of 16% year-on[1]year. In Q2, take-up excluding renewals reached 149,560 sq m, representing a 27% year-on-year growth.

In H1 2024, total demand amounted to 326,905 sq m in Hungary, showing a 17% decrease compared to the same period a year prior. Net take-up reached 275,510 sq m in the first half of the year, indicating only a 1% growth compared to the same period of 2023.

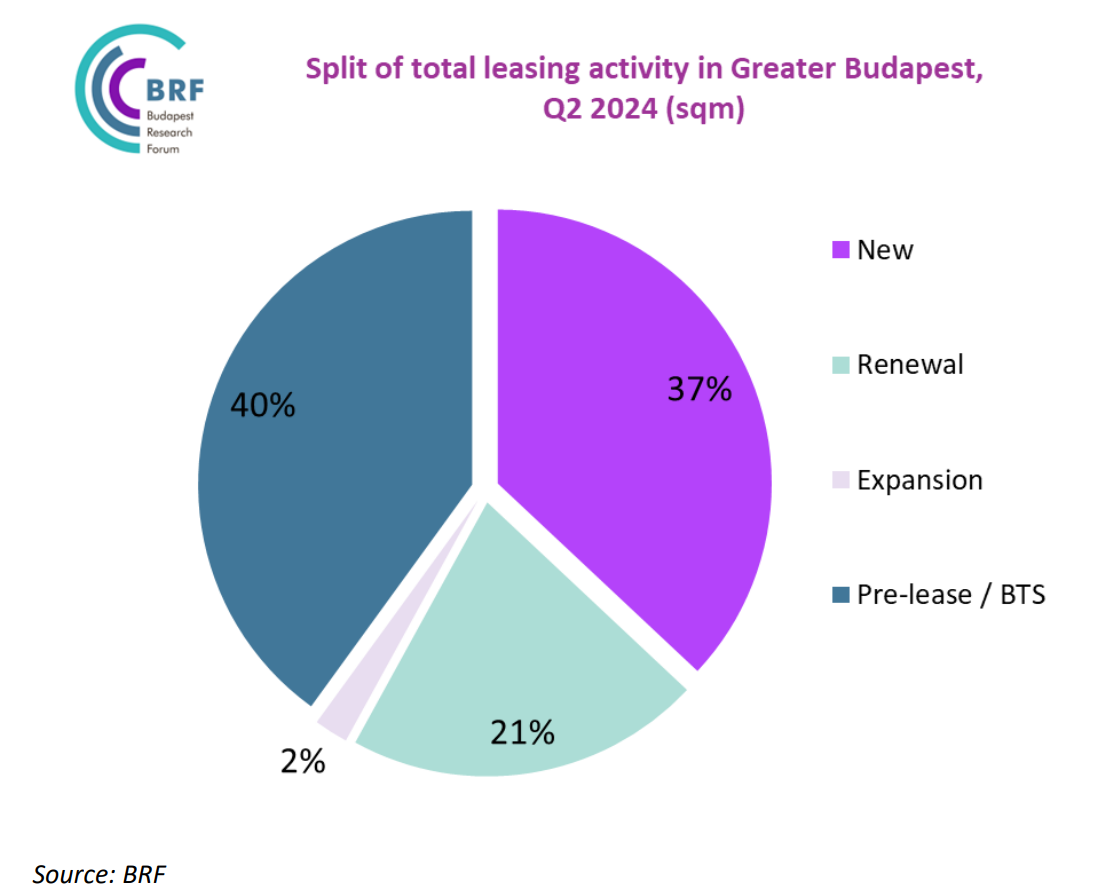

In Greater Budapest pre-leases accounted for 40% of the total leasing activity in Q2 2024, while new leases took up 37%. Lease renewalsrepresented 21% of the total leasing activity, and expansions took up only 2%. The largest transaction of the second quarter was signed for 57,000 sq m in one of the industrial parks of CTP in Greater Budapest, while the largest transaction in the regional market was a 22,000 sq m pre-lease in the VGP Park Kecskemét.

In the second quarter of 2024, 35 leasing transactions were registered in Greater Budapest, with an average transaction size of 5,380 sq m. The number of transactions was 52% higher than the data registered in the first quarter of 2024. Five of the transactions registered in Q2 2024, exceeded the size limit of 10,000 sq m. The majority of leases continued to be concluded in big-box logistics parks.

In Q2, net absorption amounted to 52,439 sq m in Greater Budapest, while in Regional Hungary it reached -7,750 sq m.

Source: BRF