Budapest Office Market Report - Q2 2024

2024.08.26.

The Budapest Research Forum (hereinafter the ‘BRF’, which comprises CBRE, Colliers, Cushman & Wakefield, ESTON International, iO Partners and Robertson Hungary) hereby reports its Q2 2024 office market summary.

The total modern office stock currently adds up to 4,440,490 sqm, consisting of 3,603,265 sqm of ‘A’ and ‘B’ category speculative office space as well as 837,225 sqm of owner-occupied office space.

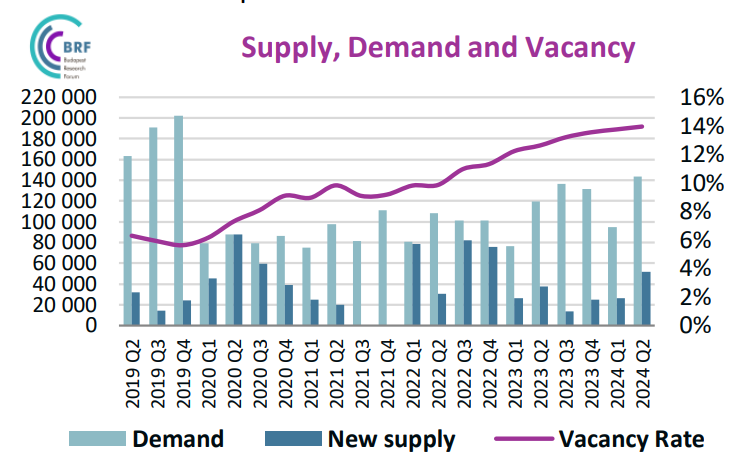

In the second quarter of 2024, four office buildings were delivered to the Budapest office market with a total of 51,845 sqm. The new, owner-occupied headquarters of Richter (17,400 sq m) was handed over, additionally BakerStreet 1 (16,645 sq m) Madarász IV (14,600 sq m) and Liget Center Auditorium (3,200 sq m) office schemes were completed. Moreover, one building was transferred to the owner-occupied office stock.

Source: BRF

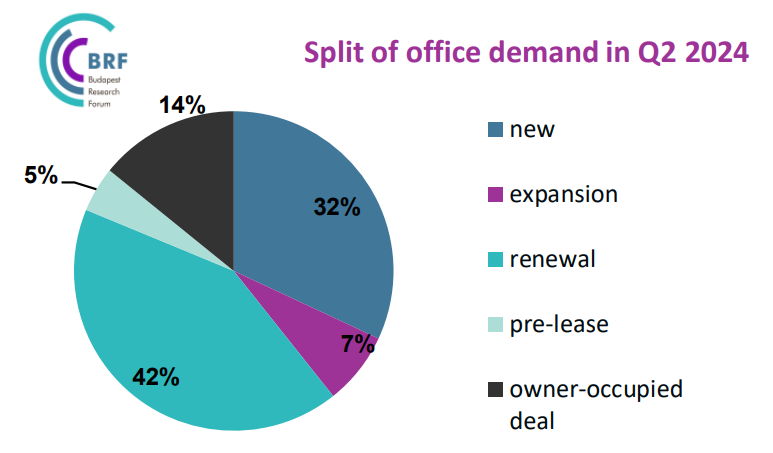

Total demand reached 143,395 sqm in Q2 2024 reflecting a 20% increase year-on-year. Renewals accounted for the largest share of total leasing activity with 42%, followed by new leases with a share of 32%. Expansions took up 7%, pre-leased reached 5%, while owner-occupied deals took up 14% of the total demand.

In H1 2024, total demand amounted to 238,400 sqm, showing an 21% increase compared to the same period a year prior. Net take-up (excl. renewals and owner[1]occupied transactions) reached 105,860 sqm in the first half of the year, indicating a 7% growth compared to the same period of 2023.

In Q2 2024, the office vacancy rate increased to 13.9%, representing a 0.2 pps growth quarter-on-quarter and 1.3 pps increase year-on-year. The lowest vacancy was registered in North Buda with a vacancy rate of 7.7%, whereas the highest vacancy rate remained in the Periphery submarket (33.2%).

Source: BRF

Net absorption turned positive in the second quarter of 2024 and amounted to 34,245 sq m.

The strongest occupational activity was recorded again on the Váci Corridor, attracting 27% of the total demand, and it was followed by Central Pest and Non-Central Pest submarkets, each submarket took up 24% of total demand in Q2 2024.

According to BRF, 162 lease agreements were concluded in Q2 2024 and the average deal size amounted to 885 sqm. The number of transactions remained in the same range compared to the second quarter of 2023, however the average transaction size has risen by 20%.

BRF registered five transactions concluded on more than 5,000 sqm office space, including three renewals, one new lease and an owner-occupied transaction. The largest transaction in the quarter was a lease renewal combined with expansion in total of 20,000 sq m in Millennium Towers. The largest new transaction of the quarter was concluded by MÁV in the new HQ of Telekom for more than 6.600 sq m.

Source: BRF